GST in E Commerce is totally a new topic of discussion in the Goods and Service Tax regime specially because the format of taxation has undergone a change in this particular area. Let us explore the topic in details as we go through the post.

Table of content

- What is e commerce or electronic commerce?

- Three parties in e commerce model

- Goods and Service Tax for e commerce operator.

- Supplies notified by Government under section 9(5) of CGST Act, 2017

- E commerce is located outside India- Deadlock for section 9(5)

- Value of Taxable Supply

- Tax collection at source (TCS) for e-commerce operators

- Compulsory registration

1.What is e-commerce or electronic commerce?

E Commerce is an online marketplace platform where goods or services could be sold and purchased. Example of e commerce operator could be Amazon, Flipkart, Ola Cabs etc.

E commerce is defined in sub section 44 of section 2 of Central Goods and Service Tax Act, 2017. It means supply of goods or services over digital or electronic network.

Similarly e commerce operator is defined in sub section 45 of section 2 of Central Goods and Service Tax Act, 2017 as person who provides digital or electronic facility over which electronic commerce could take place.

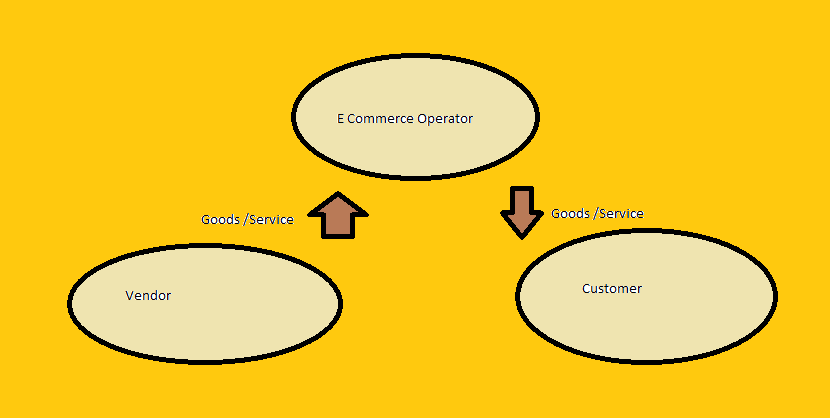

2.Three parties in e commerce model

- Supplier of Goods/Services who supplies goods or services

- Receiver of Goods/Services who is recipient of goods or services

- E Commerce operator who provides online platform for selling and purchasing of goods or services.

3.Goods and Service Tax for e commerce operator.

So the discussion for this discussion is taxability of e commerce operators in goods and service tax. Let us divide our topic under two heads – 1) Notified by the government under section 9(5) of Central Goods and Service Tax Act, 2017 and 2) Not notified by the government under section 9(5) of Central Goods and Service Tax Act ,2017.

4.Supplies notified by Government under section 9(5) of Central Goods and Service Tax Act, 2017

As the heading is self explanatory, you might have already guessed out that the goods or services are notified by the government where it feels necessary and is recommended by the GST council. Such notification is based for intra-state supplies of goods or services. With respect of such supplies the goods and service tax would be paid by the e commerce operator if such supplies are made through him. In such situation all the provisions of this act shall apply on e commerce operators as if he is the supplier of goods and service for the purpose of this act.

5.E commerce is located outside India- Deadlock for section 9(5)

Now what if the e commerce operator is located outside the taxable territory. Such situations have been dealt with in the law itself. The act makes any person representing the e commerce operator in the taxable territory liable to pay the tax under this act.

But what will happen if there is no representative of e commerce operator in taxable territory. There is nothing to worry as the act has taken great care in analyzing and implementing all the aspects in real scenario. In such situation it would be mandatory for the e commerce operator to appoint a person for the purpose of paying tax and such person would be liable to pay the tax.

6.Value of Taxable Supply for GST in E Commerce service

For all supplies other than notified by the government under section 9(5) of Central Goods and Service Tax, 2017 the taxable value shall be the amount charged by the e commerce operators from the suppliers for letting them use their e commerce platform. The e commerce operator shall pay tax on this value. Further the tax on goods or services provided by the supplier are also taxable. Such tax shall be paid by the supplier of goods or services.

On the other hand the tax for goods or supplies notified by the government under section 9(5) of Central Goods and Service Tax Act, 2017 shall be discharged by the e commerce operator. The taxable value shall be the value of goods or services supplied on such platform

7.Tax collection at source (TCS) in relation to GST in E Commerce operators

This concept has come from the income tax law. Under Section 52 of the Central Goods and Service Tax Act, 2017 the e commerce operators shall collect an amount not more than 1% of net value of taxable supplies made through them as TCS (tax collection at source). Again such supplies shall be notified by the government on recommendation of GST Council. Net taxable supplies shall include aggregate value of taxable supplies of goods or services other than supplies notified in section 9(5) of CGST Act, 2017.

Quick practical points to remember for TCS(Tax Collection at Source):

- The TCS collected by an e commerce operator shall be deposited to the government by the 10th day of the next month when the said amount (TCS) was collected.

- The e-commerce operator has to file a statement to the tax department. This statement has to be filed electronically. It should detail the total outwards supply of goods and services. Beside the details of the supplies of goods and services returned through it shall also be mentioned in the statement. The statement has to be filed monthly and the 10th of every month is the date mentioned as per law for the filing of this statement.

- Similar to the statement mentioned in the above point, a consolidated annual statement at the end of the year shall be filed by the e commerce operator. This statement shall contain the details of the outward supplies of goods and services including the returned supplies. It has to be filed by 31st of December following that particular financial year. For example the statement for financial year 2018-19 has to file by 31.12.2019.

- The actual supplier of goods and services can claim the amount of TCS (Tax Collected at Source) in its electronic cash ledger.

8.Compulsory registration

- The e commerce operators need to take compulsory registration for the purpose of paying TCS (Tax Collection at Source) to the government. It is important to note that the threshold of Rs. 20 lakhs turnover or Rs. 10 lakhs for notified states would not apply.

- The e –commerce operators needs to take compulsory registration for payment under section 9(5) of CGST Act, 2017 also.

Point iv and x of section 24 of the CGST Act,2017(Central Goods and Service Tax Act, 2017) are relevant provisions for the above points. In other words all the e-commerce operators need to compulsorily register under GST (Goods and Service Tax).

Recommended links for the above topic

- https://cleartax.in/s/gst-registration-for-ecommerce

- Book by R. K. Jain