इंग्लिश मे ई चालान के बारे पढे/Read in English |

1) ई-चालान का परिचय? Introducing E-Invoice?

प्रौद्योगिकी के सुधार के साथ यह महत्वपूर्ण हो जाता है कि अर्थव्यवस्था और शासन के हर क्षेत्र को बेहतर बनाने के लिए ऐसी उन्नति का लाभ उठाया जा सके। यहां हम भारत के कर संग्रह प्रणाली के लिए बेहतर प्रशासन और बेहतर विनियमन के बारे में बात कर रहे हैं। सरकार ने कुछ पंजीकृत करदाताओं के लिए ई चालान (E-Invoicing) प्रणाली शुरू की है। यह मूल रूप से GSTN जी.एस.टी.एन. (गुड्स एंड सर्विस टैक्स नेटवर्क) में चालान अपलोड करने और जी.एस.टी.एन. से संबंधित विभिन्न गतिविधियों को स्वचालित करने जैसे की ई-वे बिल (E-Way Bill) की ट्रैकिंग और उसे बनाने की प्रक्रिया, जीएसटी रिटर्न भरना, आपूर्तिकर्ता (supplier) द्वारा रिसीवर से इनपुट टैक्स क्रेडिट की प्राप्ति, आदि। आप इस पोस्ट के माध्यम से ई चालान से संबन्धित प्रक्रिया विस्तार मे जान सकते हैंI

2) प्रासंगिक प्रावधान (Relevant Provisions)

चालान की बनाने की प्रक्रिया केंद्रीय माल और सेवा कर नियमों, 2017 (Central GST Rule, 2017) के नियम 48 के अनुसार की जाती है। ई चालान की अवधारणा को शामिल करने के लिए इस नियम में कुछ संशोधन किए गए हैं। अधिसूचना 68/2019 सी.टी. से 72/2019 सी.टी. दिनांक 13/12/2019 प्रासंगिक अधिसूचना है। हम आने वाले विषयों में उपरोक्त सूचनाओं के प्रभाव के साथ सी.जी.एस.टी. नियमों (केंद्रीय माल और सेवा कर नियम, 2017) में किए गए प्रावधानों और सभी परिवर्तनों के बारे में जानेंगे। अभी के लिए आइए हम ई-चालान में मूल चरणों को जानें।

3) ई चालान की प्रक्रिया।

चरण 1

इनवॉइस की उत्पत्ति: PEPPOL (पैन यूरोपीय सार्वजनिक खरीद ऑनलाइन) मानक में चालान जनरेट करने के लिए सामान्य नियमों का पालन करते हुए इनवॉइस जनरेट किया जाना चाहिए। एक ERP सॉफ्टवेयर का उपयोग किया जा सकता है जो JSON प्रारूप में इनवॉइस उत्पन्न करने में सक्षम है।

चरण 2

IRP (चालान पंजीकरण पोर्टल/ Invoice Registration Portal) में इनवॉइस अपलोड करना: JSON फॉर्मेट में उत्पन्न इनवॉइस IRP यानी इनवॉइस रजिस्टरिंग पोर्टल पर अपलोड की जानी चाहिए। JSON को IRP पे API , वेब साइट और SMS – तीन तरीकों से अपलोड किया जा सकता है।

चरण 3

चालान विवरणों की वैधता: आईआरपी (चालान पंजीकरण पोर्टल) चालान पर विवरणों को मान्य करेगा और चार मापदंडों पर आधारित किसी भी दोहराव की जांच करेगा -सेलर जीएसटीआईएन, चालान संख्या, वित्तीय वर्ष और दस्तावेज़ प्रकार (चालान / क्रेडिट नोट / डेबिट नोट) )।

चरण 4

जनरेशन इनवॉइस रेफरेंस नंबर (Invoice Reference Number)/ क्यूआर कोड (QR Code) / ईमेल (E mail): सत्यापन के बाद आईआरपी संदर्भ के लिए इनवॉइस संदर्भ संख्या उत्पन्न करता है। आईआरपी डिजिटल रूप से चालान पर हस्ताक्षर करता है और JSON प्रारूप में चालान के लिए क्यूआर कोड का उत्पादन करता है। तब सिस्टम ई-चालान की पीढ़ी को सूचित करते हुए आपूर्तिकर्ता को एक ईमेल भेजता है।

चरण 5

जीएसटी रिटर्न और ई वे बिल पोर्टल का स्वचालन: IRP (चालान पंजीकरण पोर्टल/ Invoice Registration Portal) जीएसटी रिटर्न के विवरण और ई वे बिल पोर्टल को भरने के लिए ई वे बिल पोर्टल के लिए चालान की जानकारी जीएसटी पोर्टल को भेजता है। अब अगर हम चालान के लिए ई वेस्बिल बनाने की कोशिश करते हैं तो पार्ट ए इस ऑटोमेशन के परिणामस्वरूप प्रीफिल्ड हो जाएगा।

4) ई चालान के लिए किसे आवेदन करना चाहिए?

ई चालान उन करदाताओं के लिए लागू किया गया है, जिनका वार्षिक कारोबार (भारत भर में सभी GSTIN एक ही पैन (स्थायी खाता संख्या) से जुड़ा हुआ कारोबार की राशि) 100 करोड़ रुपये से अधिक है। वर्तमान में यह बी 2 बी (बिजनेस टू बिजनेस) लेनदेन में केवल एक पंजीकृत व्यक्ति से दूसरे पंजीकृत व्यक्ति को आपूर्ति के लिए है।

5) सॉफ्टवेयर की तैयारी:

जिन व्यवसायों को ई चालान सिस्टम का उपयोग करना है, उन्हें खुद को कुछ जरूरी सॉफ्टवेयर से लैस करना होगा। इन आवश्यकताओं पर निम्नलिखित बिंदुओं के तहत चर्चा की जा सकती है।

प्रथम:

ई.आर.पी. सॉफ्टवेयर जैसे SAP / TALLY / आदि जो चालान बनाने के लिए उपयोग किए जाते हैं उन्हें पी.ई.पी.पी.ओ.एल (PEPPOL)(पैन यूरोपीय सार्वजनिक खरीद ऑनलाइन) मानक का पालन करना चाहिए। यह दुनिया भर के व्यवसायों के लिए सबसे अधिक इस्तेमाल किया जाने वाला मानक है। मानक E-XML (इलेक्ट्रॉनिक एक्सएमएल) के यूबीएल/UBL (यूनिवर्सल बिजनेस लैंग्वेज) संस्करण की आवश्यकता है

दूसरा:

ईआरपी सॉफ्टवेयर JSON प्रारूप में सभी चालानों को उत्पन्न करने में सक्षम होना चाहिए क्योंकि IRP JSON प्रारूप में डेटा को संसाधित कर सकता है।

तीसरा:

आई.आर.पी. /IRP (इनवॉइस रजिस्टरिंग पोर्टल) के साथ बातचीत करने के लिए उपयोगकर्ता के पास इंटरेक्टिंग सॉफ्टवेयर / सिस्टम होना चाहिए। इसे वेब आधारित, एपीआई आधारित, एसएमएस आधारित, ऑफ़लाइन उपकरण आधारित, मोबाइल ऐप आधारित, आदि के माध्यम से पहुँचा जा सकता है। सरकार ने उन लिंक की एक सूची अधिसूचित की है जिनका उपयोग आईआरपी तक पहुँचने के लिए किया जा सकता है।

चौथा:

आपूर्तिकर्ता के पास IRP द्वारा उत्पन्न क्यूआर कोड/ QR Code का उपयोग करने के लिए एक क्यूआर रीडर हो सकता है।

6)ई चालान प्रणाली के लाभ:

जैसा कि हम चालान बनाने के अगले स्तर पर जा रहे हैं, पहले हमें इसके उपयोग के फायदों को समझें।

प्रथम:

इस प्रणाली द्वारा लाया गया स्वचालन एक स्पष्ट बात है जिसे याद नहीं किया जा सकता है। वर्तमान में रिटर्न मैन्युअल रूप से भरना होता है और ई वे बिल में विवरण भरने के लिए भी आपके अकाउंटिंग व्यक्तियों के मैनुअल प्रयास की आवश्यकता होती है। अब दोनों एक निश्चित सीमा तक स्वतः ही आबाद हो जाते हैं।

दूसरा:

इसके साथ आई.टी.सी/ITC (इनपुट टैक्स क्रेडिट) का मिलान कुछ हद तक सरल हो गया है। वर्तमान प्रणाली में आपूर्तिकर्ता द्वारा उत्पन्न चालान जीएसटीआर 1 में दर्ज किया जाना है और वही आई.टी.सी./ITC जी.एस.टी.आर. 2 ए/ GSTR 2A में रिसीवर के लिए उपलब्ध है। कई बार ऐसा होता है कि आपूर्तिकर्ता /supplier कुछ चालान अपलोड करना भूल जाता है और परिणामस्वरूप रिसीवर को वे ITC नहीं मिल पाता । अब चूंकि आईआरपी (इनवॉइस रजिस्टरिंग पोर्टल) डेटा को जीएसटीआर 1 और ई वे बिल को एक साथ भेजता है, जिसके लिए ई वे बिल जनरेट किया जाता है, जबकि रिटर्न फाइल करते समय चूक नहीं की जा सकती है।

तीसरा:

चालान के विवरण को अपलोड करने में मैनुअल त्रुटि को काफी हद तक कम किया जा सकता है।

चौथा

वर्तमान व्यवस्था से बेहतर तरीके से चालान में किसी भी अंतर की पहचान करना विभाग के लिए आसान होगा। इससे उनकी दक्षता में सुधार होगा। इसके अलावा नकली चालान के मामलों को आसानी से पहचाना जा सकता है और समय पर कार्रवाई की जा सकती है।

7) ई इन्वाइस से संबन्धित गलत धारणाओ का खंडन :

प्रथम:

सबसे आम मिथक यह है कि यह सभी करदाताओं पर लागू होता है। हालाँकि वर्तमान में यह केवल बी 2 बी /B2B चालान के साथ लागू होता है, जिसमें १०० करोड़ रुपये या उससे अधिक का कारोबार होता है, अधिसूचना 70/2019 CT dated 13/12/2019 के अनुसार आपूर्तिकरता का रिसीवर भी एक पंजीकृत व्यक्ति होना चाहिए ।

दूसरा:

यह सबसे आम गलत धारणा है। ज्यादातर लोगों को लगता है कि अब से जी.एस.टी.एन. /GSTN पोर्टल के माध्यम से चालान तैयार किया जाएगा। लेकिन जैसा कि हमने देखा है कि ईआरपी सॉफ्टवेयर के माध्यम से चालान तैयार किए जाएंगे और इनवॉइस रेफरेंस नंबर जनरेट करने के लिए विवरण आईआरपी सिस्टम में अपलोड करना होगा।

8) आगे का रास्ता

यह सरकार द्वारा चालान प्रणाली को स्वचालित करने के लिए उठाया गया एक शानदार कदम है। प्रौद्योगिकी की सहायता से कराधान /taxation में यह विकास सरहनीय है जो की करदाता सुविधा और कराधान में बेहतर प्रशासन लाएंगे। शुरुआत में तकनीकी या कार्यान्वयन संबंधी कठिनाइयाँ हो सकती हैं लेकिन उद्योग और सरकार आपसी सहयोग और विश्वास से इसे निश्चित रूप से दूर करेंगे। यह बस कुछ समय की बात है जब इस प्रणाली को करदाताओं के अन्य वर्गों तक बढ़ाया जाएगा और ऐसी उन्नति का फल सभी को मिल सकेगा।

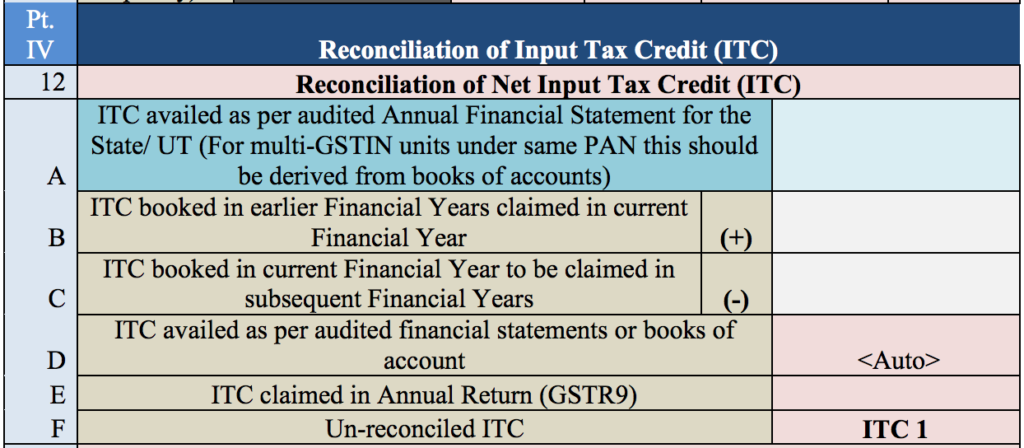

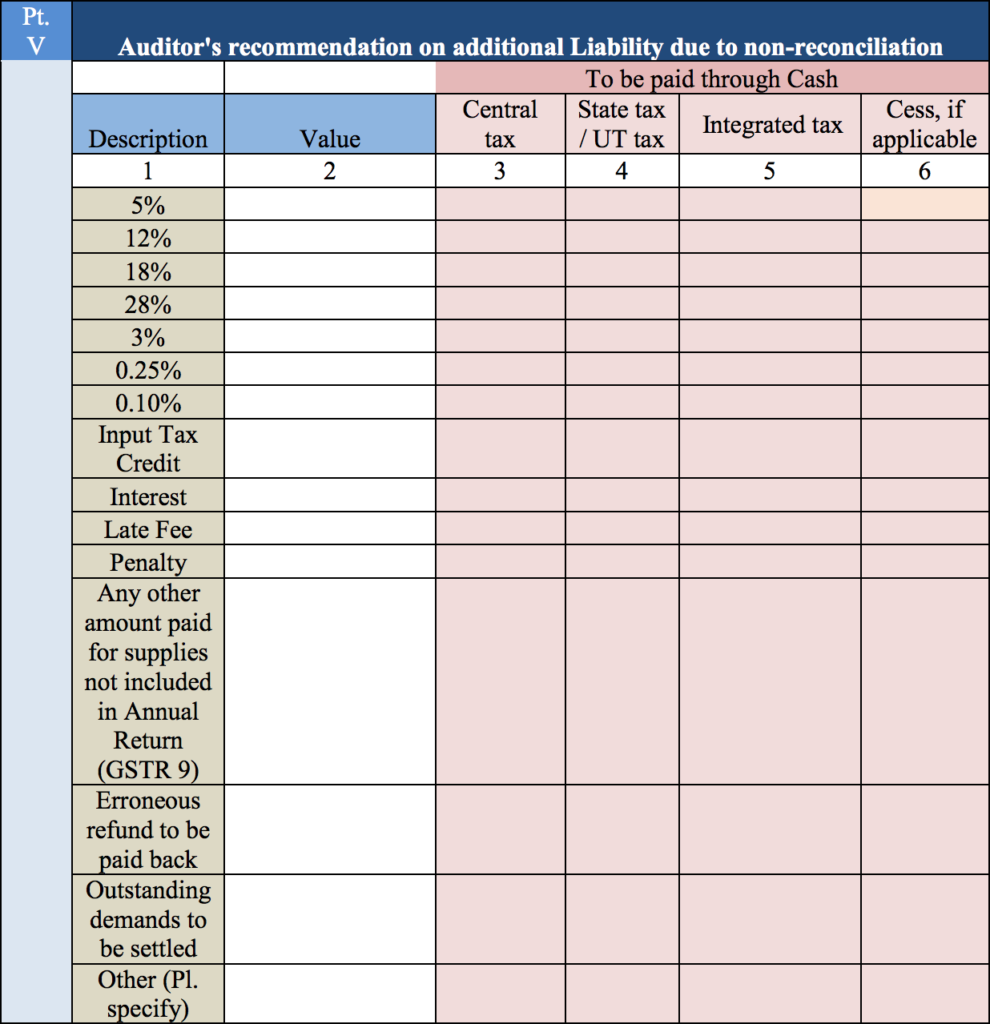

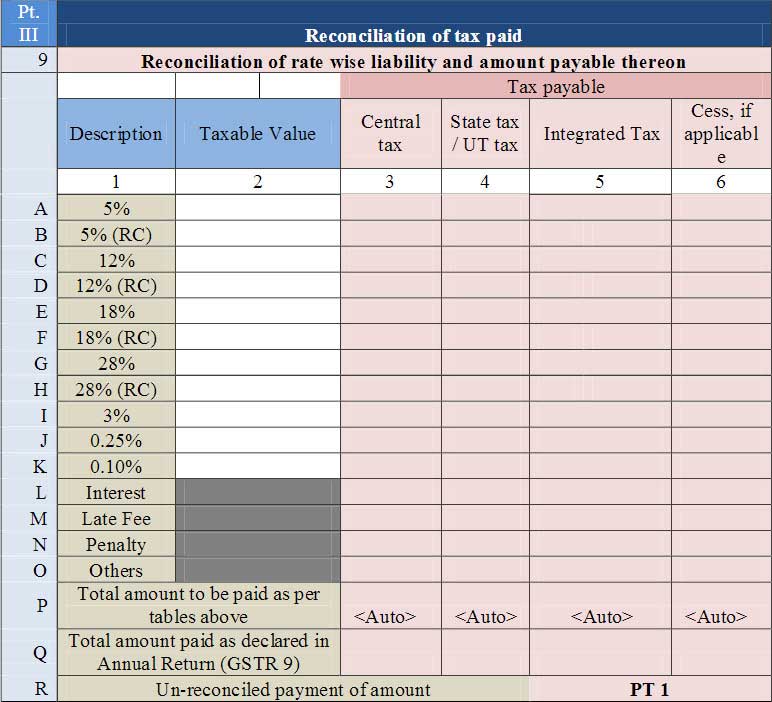

Part 3 is basically the reconciliation of tax paid by the taxpayer.

Part 3 is basically the reconciliation of tax paid by the taxpayer.