Topics covered

1. Introduction

2. Understanding the concept with an Example

3. Documents required for availing Input Tax Credit

4. Input Tax Credit in cases where the consideration involved is not paid.9 (Rule 37 of Central Goods and service Tax Rules, 2017)

5. Eligibility criteria for availing Input Tax Credit (Section 16 of CGST, 2017)

6. Goods or Services used for business as well as for other purpose (Section 17(1) of Central Goods and Service Tax, 2017)

7. Goods used for supply of exempted and non exempted supplies (Section 17(2) of Central Goods and Service Tax, 2017)

8. What does exempted and non exempted supplies include

9. Calculation where inputs/ input services are common to exempted and non exempted supplies/ business or non business use (Rule 42 of Central Goods and Service Tax Rules, 2017)

10. Credit availment in Banking Company and Financial Institutions:

11. Non availability of Input Tax Credit as per section 17(5) of Central Goods and Service Tax, 2017

12. Availability of Input Tax Credit in Special Circumstances (Section 18 of Central Goods and Service Tax Act, 2017)

13. Conclusion

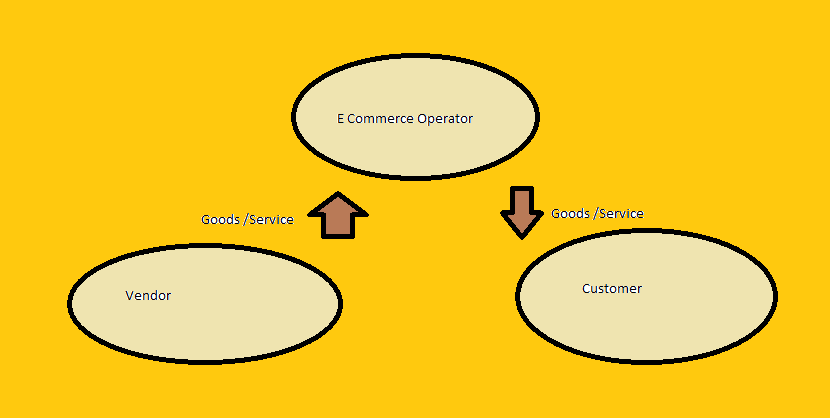

1. Introduction

One of the advantages of Goods and Service Tax is elimination of cumulative taxation as a manufactured product get through more than one stage of production. Input Tax Credit enables to tax only the value addition at each stage of production. The same is true for the provision of service. Here the manufacturer or the service provider is allowed to take credit of inputs or input services used in manufacture or provision of service. He may later use this credit to discharge his tax liability.

2. Understanding the concept with an Example

Let us understand this concept using an example. A glass window manufacturer manufactures glass window. This process of manufacturing requires inputs such as glass, window frame, hook, glue etc. When he procures these items he pays GST which is included in the invoice of the vendors. When he finally manufactures and clears the glass window he is again collecting and paying the GST on the final value of window. It is to be noted that this value includes the cost of inputs along with GST paid thereon. This window may be a part of a building where again GST may be payable when someone purchases a flat in the building. In this example we see that GST is charged thrice till the final consumer buys the item. However it is not in spirit of taxation to charge the same product or service thrice at different stages. Instead tax should be charged at the value addition at each stage. So the concept of Input Tax Credit is developed. In this the glass window manufacturer may take credit of inputs i.e. glass, hook, window pane etc. He may later use this credit to discharge his tax liabilities. In this way the tax levied on the inputs is nullified by the input tax credit available to the window manufacturer. Similarly the builder may take credit of window and discharge liability while selling his flat.

Let the glass costs Rs. 100/- and GST is 10%(assumed). So the selling price becomes be Rs. 110/-. Now the glass manufacturer buys this glass at Rs. 110/-. Let profit and other costs be Rs. 100/-. So he manufactures glass at Rs. 210/-(110+100). On including GST 10% the final cost becomes Rs. 231/- (210+10% of 210) if no input tax credit is available. With input tax credit, the price of glass is Rs. 110/-. The glass window manufacturer takes Rs. 10/- credit on buying glass which he can use for paying tax. So now he can sell the same window at Rs.200/- (100+100) plus tax. This is Rs. 210/-(200+ 10% of 200). So you can clearly see the benefit of input tax credit. The price of the same article is reduced. Further the tax is suffered by the goods at each value addition.

3. Documents required for availing Input Tax Credit

The input Tax credit is available to a registered person or a Input Service Distributor on the production of the following documents

- Invoice issued by the supplier of goods or services

- Invoice issued by in accordance to the provision of section 31(3)(f). This provision is related to self invoicing under reverse charge mechanism. Kindly follow the post on Reverse Charge Mechanism to understand it in details.

- Debit note issued by the supplier of goods or service.

- Bill of Entry or any similar documents prescribed in the Customs Act, 1962 or related rules.

- Credit note or other documents issued by Input Service Distributor.

The documents mentioned above should contain the following details

- Amount of tax charged

- Description of goods or services

- Total value of supply

- GSTIN number of supplier and recipient

- Place of supply

It is to be mentioned that Input Tax Credit availed on payment pursuant to any demand by tax authorities based on willful misstatement , fraud or suppression of facts shall not be allowed.

4. Input Tax Credit in cases where the consideration involved is not paid (Rule 37 of Central Goods and service Tax Rules,2017)

A recipient of goods or services may avail the tax immediately on receiving the invoice from the supplier. However if he fails to make payment to the supplier within 180 days he has to reverse the amount of tax credit availed by him on such inputs or input services. The recipient in this case is liable to pay interest from the date of availing credit till the date when the credit is reversed.

Such supplies have to be declared in FORM GSTR-2 for the month immediately following 180 days as discussed above.

The recipient is allowed to avail the credit as soon as the payment is made by him.

5.Eligibility criteria for availing Input Tax Credit (Section 16 of Central Goods and Service Tax Act, 2017)

The following are the eligibility criteria to be complied with for availing Input Tax Credit:

- The registered person availing such Input Tax Credit is in possession of such invoice.

- The person availing credit has received the goods and services to which the invoice pertains.

- The tax charged in the invoice is actually paid to the government.

- The person availing such credit has made payment to the supplier of goods or service within 180 days of issue of invoice.

- If the recipient of goods is receiving the goods in multiple lots then he may avail the credit after receiving the final lot.

- The registered person may avail the Input Tax Credit on any invoice or debit note on supply of goods or service till the last date of filling the return of September month coming after the financial year to which the invoice or debit note pertains. For example if the date of invoice is 30.12.2018 then he may avail the credit upto the last date of filling September’2019 returns.

- Input Tax Credit on Capital Goods can be availed if the person has not claimed depreciation on tax component of cost of capital goods under provision of Income Tax Act,1961.

6.Goods or Services used for business as well as for other purpose (Section 17(1) of Central Goods and Service Tax, 2017)

If input goods or input services are used for business as well as for other non business purpose then the recipient is eligible to take only that much credit which is attributable to his business purpose only. We will examine the case where the inputs or inputs are common to both and process to separate the eligible credit in later section.

7.Goods used for supply of exempted and non exempted supplies (Section 17(2) of Central Goods and Service Tax, 2017)

There may be situation where input goods or input services are used for exempted supplies as well as for non-exempted supplies. Then the recipient is eligible to take only that much credit which is attributable to his non-exempted supplies only. We will examine the case where the inputs or inputs are common to both and process to separate the eligible credit in later section.

8.What does exempted and non exempted supplies include

Exempted supplies include

- Supplies exempted by any notification or otherwise

- Supplies where the recipient is liable to pay tax under Reverse Charge Mechanism.

- Transaction in securities.

- Sale of land.

- Sale of building after completion.

Non exempted supplies shall include:

- Supplies where no exemption is provided by any notification or otherwise

- Zero rated supplies

9.Calculation where inputs/ input services are common to exempted and non exempted supplies/ business or non business use (Rule 42 of Central Goods and Service Tax Rules, 2017)

Let,

T= Total Input Tax Credit involved in a tax period.

T1= Part of T, used for activities which are not related to business.

T2= Part of T, attributable to input / input services used exclusively for exempted supplies.

T3= Part of T, attributable to inputs/ input services where credit cannot be availed under section 17(5) of Central Goods and Service Tax Act, 2017.

T4= Amount of Input Tax Credit attributable to input/ input services used exclusively for providing non exempted supplies.

C= Common credit attributable to supply of exempted and non-exempted supply/ business and non-business supplies then,

C= T-[T1+T2+T3+T4] à1

Now if we consider,

D1= Input Tax Credit attributable to exempted supply

E= Turnover of exempted supplies.

F= Turnover of total supplies.

Then,

D1= C x (E / F)

If common inputs / input services are used partly for non business and partly for business purpose, then part attributable to non-business purpose be D2 then,

D2= 5% of C

Now the part of common credit attributable to non-exempted and business purpose shall be Cf,

Cf = C-[D1+D2]

So now the recipient of inputs or input services is eligible to avail credit of T4 and Cf.

In practical scenario such calculation may be difficult. So the easy way is to avail the entire credit except T2 and T3. Then reverse the credit amount D1 and D2.

10. Credit availment in Banking Company and Financial Institutions:

For availment of Input Tax Credit for banking company / financial institution two options are available

- The registered institution may avail or reverse the credit in accordance to Rule 42 of Goods and Service Tax, 2017 which is already discussed above.

- The institution may reverse 50% of total tax credit which is available with him.

11. Non availability of Input Tax Credit as per section 17(5) of Central Goods and Service Tax, 2017

The recipient of inputs or input services shall not be eligible to take Input Tax Credit on the followings:

- Motor vehicles used for transportation having seating capacity not more than 13 persons (including driver) except in cases where motor vehicle is used for

- Further supply of motor vehicle

- Transport of passengers

- Imparting training on driving of motor vehicle

- Vessels or aircraft except when used for

- Further supply of such aircrafts / vessels.

- Transportation of passengers

- Imparting training for navigation of vessels or flying of such aircrafts.

- Transportation of goods.

- Services of General Insurance, servicing, repair and maintenance of motor vehicle , vessels or aircraft. However credit is allowed to be availed if the same is used for the furtherance of same line of business.

- Foods and beverage, outdoor catering, beauty treatment , health service, cosmetics and plastic surgery, leasing, renting or hiring of motor vehicles, vessels or aircraft, life insurance and health insurance.

- Membership of club, health and fitness centre.

- Travel benefit extended to employees on vacation such as leave or home travel concession. However such credit can be availed if it is obligatory for the employer to provide it to their employees under the law at that time.

- Works contract service when supplied for construction of immovable properties (other than plants and machinery). This credit may be allowed if the services are used for further supply of works contract service.

- Goods and service received for the construction of immovable properties (except plant and machinery). This may be allowed if used for further supply of works contract service.

12. Availability of Input Tax Credit in Special Circumstances (Section 18 of Central Goods and Service Tax Act, 2017)

- There are circumstances where the recipient of goods and service is allowed to take input tax credit of good lying in stocks, semi finished, finished goods and capital goods. These are the special circumstances which are discussed below:

- A person who has applied for registration within 30 days from the date on which he becomes liable for registration and has been granted registration.

- A person who takes registration under registration under the provisions of Section 25(3) of Central Goods and Services Tax Act, 2017.

- A person who ceases to pay tax under section 10 (composition levy) and becomes liable to pay tax under normal tax structure (section 9 of CGST, 2017).

- When an exempt supply becomes taxable for a person then the credit mentioned above pertaining to such taxable supplies is available to him.

Condition of availing input tax credit under above circumstances

- Input Tax Credit can be availed on invoices which are not more than 1 year old. This one year is calculated from the date of invoice.

- Credit on capital goods shall be reduced on pro rata basis before availing. For example ,

Suppose the total credit available on capital goods be Rs.1, 00,000/- and the useful life of capital goods be 5 years. The capital goods is already 3 years old and so only 2 years (5-3) of useful life is remaining. So the credit that can be availed is Rs. (2/5)* 100000= Rs.40, 000/-

Formula:

ITC on Capital goods= (Useful life remaining/ Total useful life of capital goods )* Total ITC available on such Capital Goods

- If the invoices of inputs held in stock are not available then the input tax credit is calculated from the prevailing market price of the goods. The Input Tax Credit may be availed accordingly.

- In case of sales, mergers, demerger, amalgamation, lease or transfer of business the transferor of business may make the unutilized Input tax Credit in his electronic credit ledger available to the transferee of business. This credit may be taken by the new business in its electronic credit ledger.

- If a person opts to pay tax under section 10(Composition levy) of this Act, then he has to pay the amount by debit in his electronic credit ledger. This amount shall be equivalent to the sum total of the credit contained in goods or input services lying in stock, semi finished goods, finished goods and capital goods

13.Conclusion :

Input Tax credit is an important part of the seamless flow of capital in the business. Hence requirement of a clear understanding of this concept need not be overemphasized. Lawbanyan hopes that it has provided you a fair understanding of the topic. If you have missed anything it is recommended to go through the post again. If you still have questions you are free to post your queries below.

You may also read about Input Service Distributor from the link