This post describes the list of services under Reverse Charge Mechanism (RCM) . In the discussion below the points from 1 to 19 are as per section 9(3) of Central Goods and Service Tax Act, 2017 (CGST Act, 2017). Points 20 and 21 relates to the provisions of Integrated Goods and Service Tax Act, 2017 (IGST Act, 2017) . This is the complete and updated list as on March 2020.

In all the below mentioned cases the liability of tax arises on the recipient of service and hence the tax is payable by him. For the easy reference of the readers clickable list items are created below.

- Supply of Services by Goods and Transport Agency

- Supply of service by advocates

- Supply of service by arbitral/ tribunal

- Supply of Sponsorship Service

- Services provided by Central Government, State Government, Union Territory or Local Authorities excluding some specified services

- Renting of immovable property service provided by Central Government, State Government, Union Territory or Local Authorities

- Service provided by the way of transfer of development rights or Floor Space index

- Service by director of a company/ Body Corporate

- Service by an insurance agent to any person carrying insurance business

- Service by a recovery agent to banking company or financial institution or non banking financial company

- Supply of service by music composers, photographer, artists etc.

- Supply of service by an author

- Supply of service by members of Overseeing Committee to Reserve Bank of India

- Service by an Individual Direct Selling Agent (DSAs) to any banking or Non Banking Financial Company (NBFC)

- Service by a Business Facilitator (BF) to a banking company

- Service provided by an agent of Business Correspondent (BC) to Business Correspondent (BC):

- Security Services

- Service by the way of renting of motor vehicle

- Lending of securities under Securities Lending Scheme, 1997 of SEBI (Security Exchange Board of India) as amended

- Import of Service

- Service provided by the way of transportation of goods by vessel outside India up to customs station

1.Reverse Charge Mechanism on supply of Services by Goods and Transport Agency –

Type of service:

Transportation of Goods by road to –

- any factory governed by the Factory Act 1948.

- any society registered under the Societies Registration Act,1860

- any cooperative society established by or under any law

- any person registered under CGST, SGST or IGST

- any body corporate established under any law

- any partnership firm whether registered or not under any law

- any casual taxable person.

Supplier of service:

Goods Transport Agency who has not paid CGST, SGST or IGST for the said service

Recipient of Service:

- Any factory governed by the Factory Act 1948 to who receives the said service.

- Any society registered under the Societies Registration Act,1860 who receives the said service.

- any cooperative society established by or under any law

- any person registered under CGST, SGST or IGST

- any Body Corporate established under any law

- any partnership firm whether registered or not under any law

- any casual taxable person.

Note: At times situation confuses in determining the recipient of service (the sender of goods or receiver of goods). Here the person who makes the payment to the Goods Transporter is generally considered as the recipient and tax liability is borne by him.

2. Reverse Charge Mechanism on supply of service by advocates

Type of Service:

Individual advocate or firm of advocate provides legal services. These legal services are taxable supplies taxed under RCM (Reverse Charge Mechanism). These legal services include legal advice, legal consultancy, legal assistance, representational service before any court/ tribunal etc.

Supplier of Service:

Individual Advocates or firm of advocates supply these services.

Recipient of Service:

Any business entity located in the taxable territory of India receives these services.

3. Reverse Charge Mechanism (RCM) on Supply of service by arbitral/ tribunal

Type of Service:

Any service provided by an arbitral or tribunal is considered under RCM (Reverse Charge Mechanism)

Supplier of Service:

Arbitral or Tribunal provides any service.

Recipient of Service:

Any business entity located in the taxable territory.

4. Reverse Charge Mechanism on supply of Sponsorship Service

Type of Service:

The supplier provides Sponsorship service is this case.

Supplier of Service:

Any person may provide the sponsorship service

Recipient of Service:

Any Body Corporate or partnership firm located in taxable territory of India receives the supply

5. Services provided by Central Government, State Government, Union Territory or Local Authorities excluding some specified services

Type of Service:

Reverse Charge Mechanism (RCM) applies to any service provided by the government excluding the following services

- Renting of immovable property (explained in next section) and

- The below mentioned services

Supplier of Service:

Government – Central Government/ State Government/ Union Territories / any local authority supplies such services

Recipient of Service:

Any Business Entity in the taxable territory receives such services

6. Renting of immovable property service provided by Central Government, State Government, Union Territory or Local Authorities

Type of Service:

Renting of Immovable property is the service provided by the supplier.

Supplier of Service:

Government – Central Government/ State Government/ Union Territories / any local authority supplies such services

Recipient of Service:

The service is received by any person registered under the CGST Act 2017(Central Goods and Service Tax Act, 2017)

7.Service provided by the way of transfer of development rights or Floor Space index

Type of Service:

The provider of service provides the service in form of transfer of development rights or floor space index

Supplier of Service:

Any person may be the supplier who provides the development rights or floor space index for any activity.

Recipient of Service:

Promoter undertaking the task after receiving such development right or floor space index is the recipient of service.

8. Service by director of a company/ Body Corporate

Type of Service:

The director provides service to a company where he has assumed directorship. Reverse Charge Mechanism is applied on such services. However if the director provides any service to the company while being in employer-employee relationship with the said company, then taxability under Goods and Service Tax Act 2017 does not arise.

Supplier of Service:

Director is the supplier or service.

Recipient of Service:

The company or any Body Corporate where he has assumed directorship is the recipient of service and is thus liable to discharge tax.

9. Service by an insurance agent to any person carrying insurance business

Type of Service:

The insurance agent provides service to a person carrying insurance business

Supplier of Service:

Definitely the insurance agent is the supplier of service.

Recipient of Service:

The person located in taxable territory, carrying insurance business and getting service from the insurance agent is the receiver/ recipient or service.

10. Service by a recovery agent to banking company or financial institution or non banking financial company:

Type of Service:

A recovery agent supplies services to the banking company or financial institution or non banking financial company.

Supplier of Service:

The recovery agent supplies the service.

Recipient of Service:

The banking company, Non-banking Financial Institutions or any other financial institution receives the service.

11. Supply of service by music composers, photographer, artists etc.:

Type of Service:

Music Composers, photographers and artists may transfer or permit the use of the copyright present in their name under the Copyright Act, 1957 relating to their artistic work to Music Company, producer, etc.

Supplier of Service:

The Music Composer, photographer or artist who transfer or permits the use of copyright is the supplier.

Recipient of Service:

Music Company, producers etc who make use of the copyright privilege are recipient of service.

12. Reverse Charge Mechanism on supply of service by an Author:

Type of Service:

An author may transfer or permit the use of the copyright present in their name under the Copyright Act, 1957 relating to original literary work to any publisher.

Supplier of Service:

The author who transfer or permits the use of his literary work is the supplier.

Recipient of Service:

The publisher who uses the literary work of the author is the recipient of service.

13. Supply of service by members of Overseeing Committee to Reserve Bank of India:

Type of Service:

Any service provided by the member of the Overseeing Committee.

Supplier of Service:

In such cases the Overseeing Committee members are supplier for the purpose of taxation.

Recipient of Service:

RBI (Reserve Bank of India) is the recipient of service.

14. Service by an Individual Direct Selling Agent (DSAs) to any banking or Non Banking Financial Company (NBFC)

Type of Service:

Services provided by individual Direct Selling Agents (DSAs) to any banking or Non Banking Financial Company (NBFC).

Supplier of Service:

The individual Direct Selling Agents (DSAs) are supplier in this case. It is to be noted that these DSAs shall not be any Body Corporate or partnership firm in order to come under the ambit of Reverse Charge Mechanism.

Recipient of Service:

The Banks or Non Banking Financial Company (NBFCs) is recipient for the above service provided they are located in taxable territory.

15. Service by a Business Facilitator (BF) to a banking company.

Type of Service:

The Business Facilitator provides Business Facilitation service.

Supplier of Service:

Business facilitator is the supplier.

Recipient of Service:

A banking company located in the taxable territory is the recipient of service.

16. Service by an agent of Business Correspondent (BC) to Business Correspondent (BC):

Type of Service:

An agent of Business Correspondent provides services to the Business Correspondent (BC)

Supplier of Service:

The agent of Business Correspondent is the provider/ supplier of service.

Recipient of Service:

A Business Correspondent in taxable territory availing the services from the agent is the recipient.

17. Reverse Charge Mechanism on Security Services:

Type of Service:

Security service is provision of service by the way of supply of security personnel to registered personnel. However the concept of RCM (Reverse Charge Mechanism) does not apply to the following persons:

a)The Department of Establishment of Central or State Government, local authority or government agencies who are registered merely for deduction of TDS u/s 51 but are not the provider of services.

b) Any person, providing the service, who is registered under Composition Scheme in section 10 of the CGST, 2017(Central Goods and Service Tax Act, 2017).

Supplier of Service:

The person providing the security personnel is provider of service. The provider should not be a Body Corporate for the applicability of RCM (Reverse Charge Mechanism).

Recipient of Service:

Any registered person in the taxable territory can be a recipient of security services.

18. Reverse Charge Mechanism on service by the way of renting of motor vehicle

Type of Service:

This service includes renting of motor vehicle to Any Body corporate by a person who is paying tax and eligible to avail Input Tax Credit.

Supplier of Service:

Any person who rents motor vehicle to Any Body corporate and is eligible to avail Input Tax Credit can be the provider of service.

Recipient of Service:

Any Body Corporate located in taxable territory of India can be the receiver of service.

19. Lending of securities under Securities Lending Scheme, 1997 of SEBI (Security Exchange Board of India) as amended:

Type of Service:

The Service of lending of securities under Securities Lending Scheme, 1997 of SEBI (Security Exchange Board of India) is taxable under RCM (Reverse Charge Mechanism).

Supplier of Service:

The lender of securities is the supplier of service. To be more specific the lender deposits the securities which he/she holds with a intermediary for the purpose of lending under the Securities Lending Scheme, 1997 of SEBI (Security Exchange Board of India).

Recipient of Service:

The Borrower of security is the recipient. Borrower is the person who borrows the money under the Securities Lending Scheme, 1997 of SEBI (Security Exchange Board of India).

20. Reverse Charge Mechanism on Import of Service:

Type of Service:

A person outside the taxable territory provides any service to any person located in taxable territory of India. Such type of services falls under the concept of Reverse Charge Mechanism (RCM).

Supplier of Service:

A person outside the taxable territory of India is the supplier of service.

Recipient of Service

Any person located in taxable territory of India excluding the non taxable online recipient is the recipient of service.

21. Service provided by the way of transportation of goods by vessel outside India up to customs station:

Type of Service:

This service includes service provided by the way of transportation of goods by vessel outside India up to customs station.

Supplier of Service

Any person located in nontaxable territory is the supplier.

Recipient of Service

The Importer of Goods as defined in the Customs Act, 1962 is the recipient of service.

Also learn about the concept of valuation in GST.

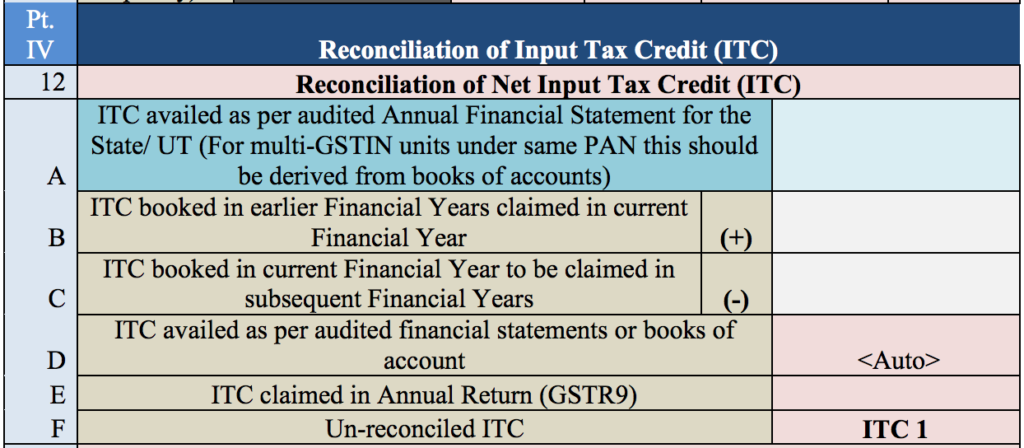

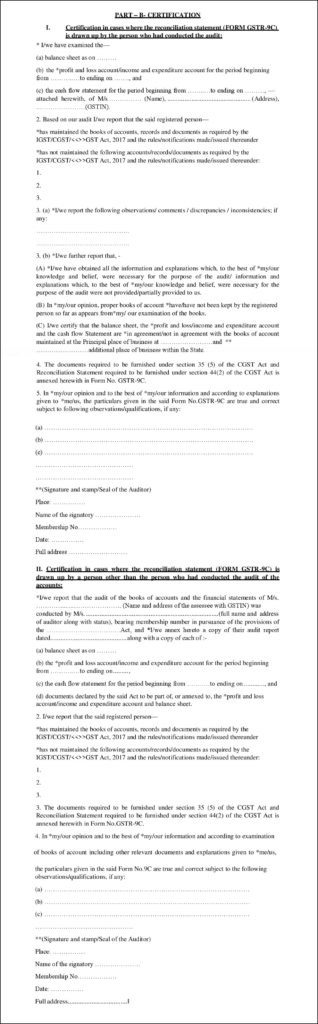

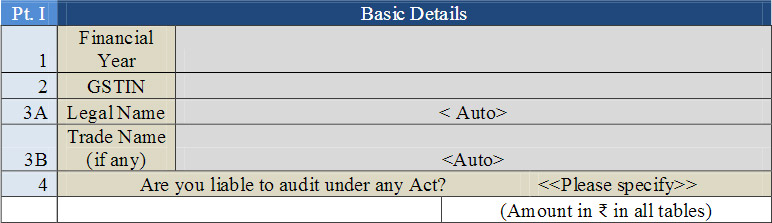

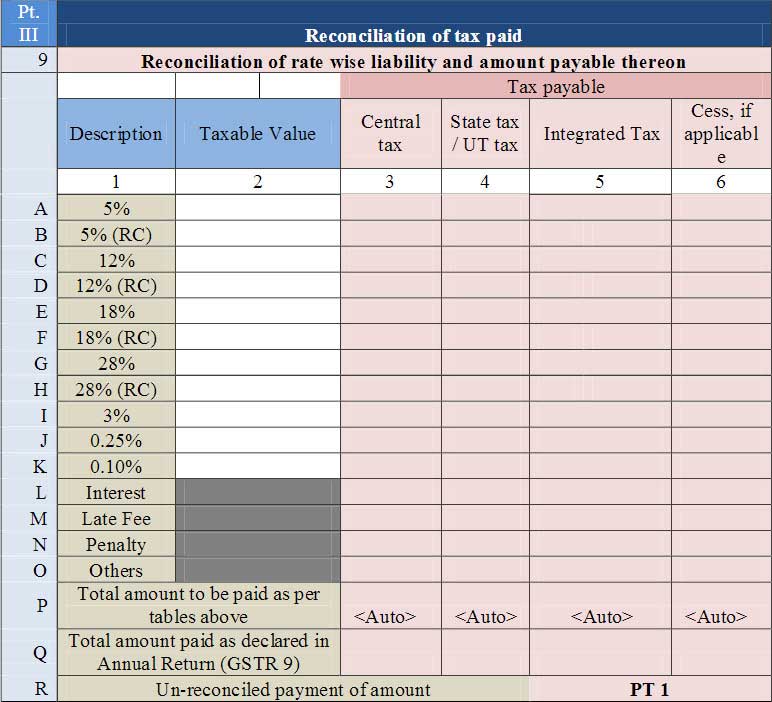

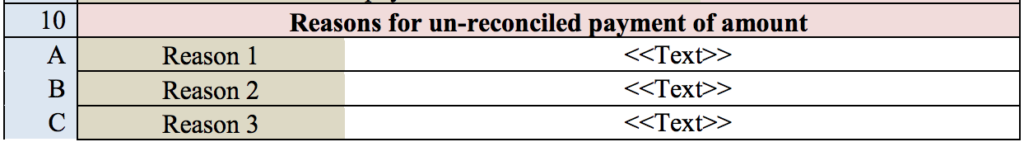

Part 3 is basically the reconciliation of tax paid by the taxpayer.

Part 3 is basically the reconciliation of tax paid by the taxpayer.